Outsmarting Scams Every Season

In a nutshell:

Black Friday and the wider holiday shopping season represent the perfect mix of excitement and risk. Massive discounts, sold-out products suddenly “back in stock,” last-minute gift pressure—scammers know exactly how to weaponize all of it. Each year, they refine their methods, tapping into new technologies, social engineering tricks, and the psychology of rushed shoppers.

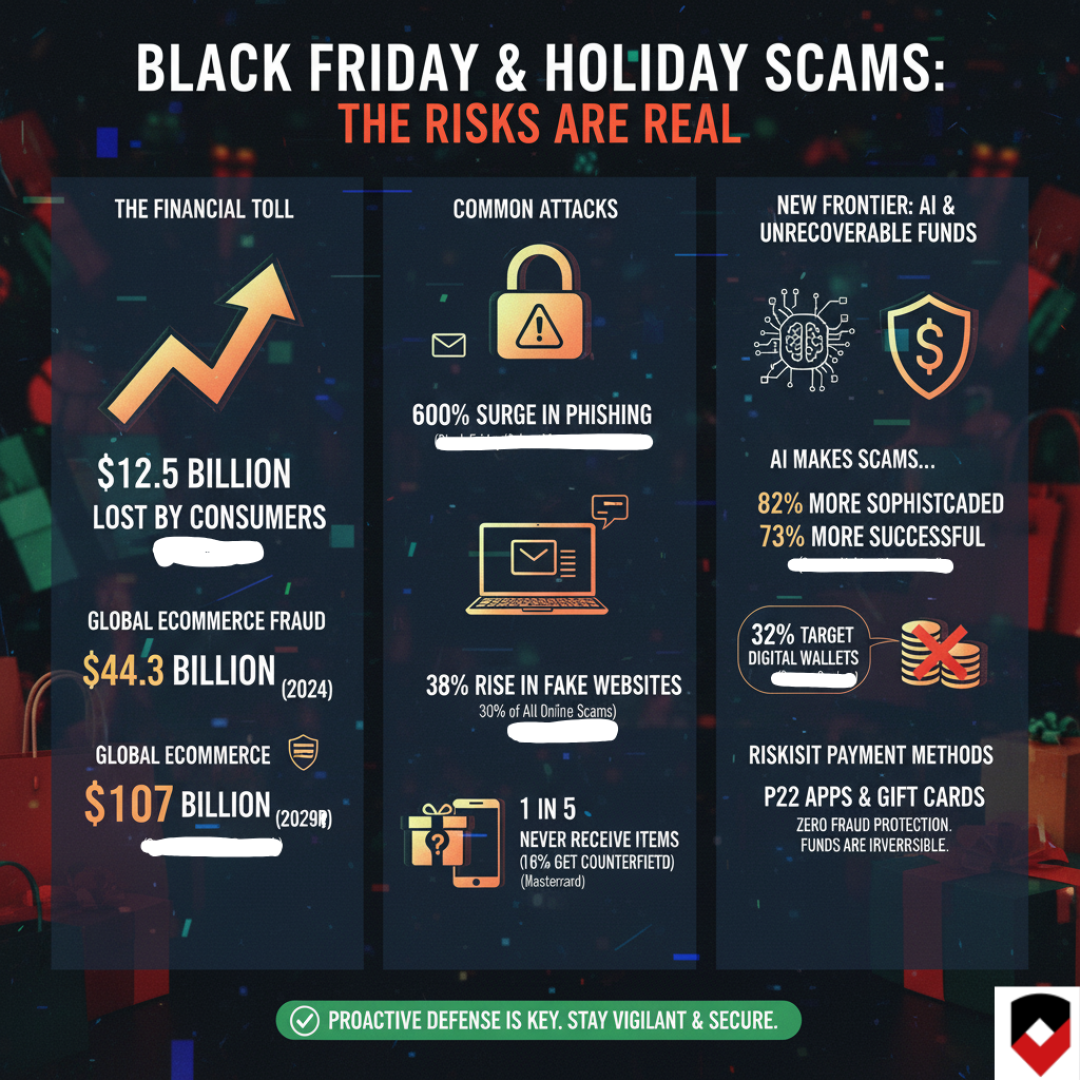

The stakes are rising fast. Global eCommerce fraud losses reached an estimated $44.3 billion in 2024 and are expected to surge to $107 billion by 2029 — a staggering 141 percent jump in just five years (Juniper Research). Consumers feel this impact directly. According to the Federal Trade Commission, fraud losses reported by individuals climbed past $12.5 billion in 2024, up 25 percent from the previous year.

These are not just numbers. Behind every statistic is someone who lost money, had their identity compromised, or spent months trying to recover. It does not have to be this way. Protecting yourself during the holiday season is not only about avoiding a bad purchase. It is about safeguarding your finances, your personal information, and your peace of mind.

This guide equips you with the same core principles cybersecurity professionals use daily: vigilance, skepticism, and strategic decision-making.

Key Takeaway: Scammers evolve rapidly. Your ability to question what you see, verify before you act, and stay skeptical remains your most reliable defense.

Phishing emails and smishing texts remain the backbone of holiday fraud. Scammers impersonate Amazon, Walmart, UPS, FedEx, your bank, or even your credit card provider.

The lure: urgent delivery notices, fake order confirmations, “suspicious activity” alerts.

The goal: push you into clicking a malicious link or entering your credentials on a fake login page.

Pro Tip: Never trust links in unsolicited messages. Go directly to the official site or app and check your account from there.

Scammers create polished fake storefronts that look indistinguishable from real brands. These sites are often pushed through paid ads or viral social posts.

The lure: impossible discounts, rare items suddenly available, countdown timers.

The goal: steal your payment details, deliver counterfeits, or ship nothing at all.

Pro Tip:

Counterfeit sellers thrive on Facebook Marketplace, Instagram shops, Telegram groups, and eBay.

The lure: luxury goods or trending electronics at half the normal price.

The goal: unload cheap fakes or vanish after payment.

Pro Tip: Check seller ratings, ask for proof of authenticity, and avoid anyone insisting on wire transfers or gift cards.

Scammers exploit holiday hype with fake coupons, viral “giveaways,” and fraudulent promo codes.

The lure: free gift cards, 70 percent discounts, “you’ve won” messages.

The goal: grab your personal information or push you to malicious links.

Pro Tip: Confirm all offers directly on the retailer’s official website.

Gift cards are the scammer’s dream currency because they are fast, untraceable, and irreversible.

The lure: demands for payment for taxes, bills, purchases, emergencies, or tech support.

The goal: drain the funds instantly so you have no recourse.

Pro Tip: No legitimate company, agency, or support service asks for gift card payments. Ever.

Scammers use increasingly convincing vishing calls to create panic.

The lure: “fraud detected,” “your account is locked,” or urgent payment issues.

The goal: pressure you into revealing one-time codes, PINs, or passwords.

Pro Tip: Hang up immediately. Call the bank back using the number on your card or their website.

AI has dramatically raised the stakes.

The lure:

The goal: override your natural skepticism with hyper-realistic deception.

Pro Tip: Verify any urgent or emotional request through a separate known channel, not the one used to contact you.

Zelle, Cash App, and Venmo are convenient, but once money leaves your account, it’s almost always gone for good.

The lure: sellers demanding P2P payments, fake overpayment refunds, or “urgent” transfers from compromised accounts.

The goal: trap you in irreversible transactions.

Pro Tip: Only use P2P apps for people you personally know. Never for online purchases.

Some deals hide long-term recurring fees in tiny print.

The lure: free trials or steep discounts with “automatic renewal.”

The goal: lock you into monthly charges you don’t notice until it’s too late.

Pro Tip: Scan all terms carefully and check your bank statements throughout the season.

Strong, unique passwords for every account

Two-factor authentication on email, bank, and shopping apps

Shopping only on secure Wi-Fi or through a trusted VPN

These simple habits shut down a huge portion of attack attempts before they start.

FAQs

What is the fastest way to identify a scam?

If the price is dramatically below market value, assume risk.

Are social media ads safe to buy from?

Not by default. Scammers pay for ads too. Always verify the seller.

Should I ever send gift cards or P2P payments to sellers?

No. These methods offer zero protection.

How do I check if a website is legitimate?

Inspect the URL, confirm real reviews, and use a reputable website checker.

What should I do if I realize I was scammed?

Contact your bank immediately, secure your accounts, and report the fraudulent site or seller.

Holiday scams move fast, and scammers count on you rushing. The ScamAdviser app helps you slow down, verify, and avoid dangerous traps before they hit.

With the app, you can:

In a season full of urgency, countdown timers, and tempting offers, having ScamAdviser in your pocket gives you a serious advantage. Download the app before you start shopping and protect yourself with confidence.

Disclaimer: Some of the links in this post are affiliate links. If you click them and make a purchase, we may earn a commission at no extra cost to you.