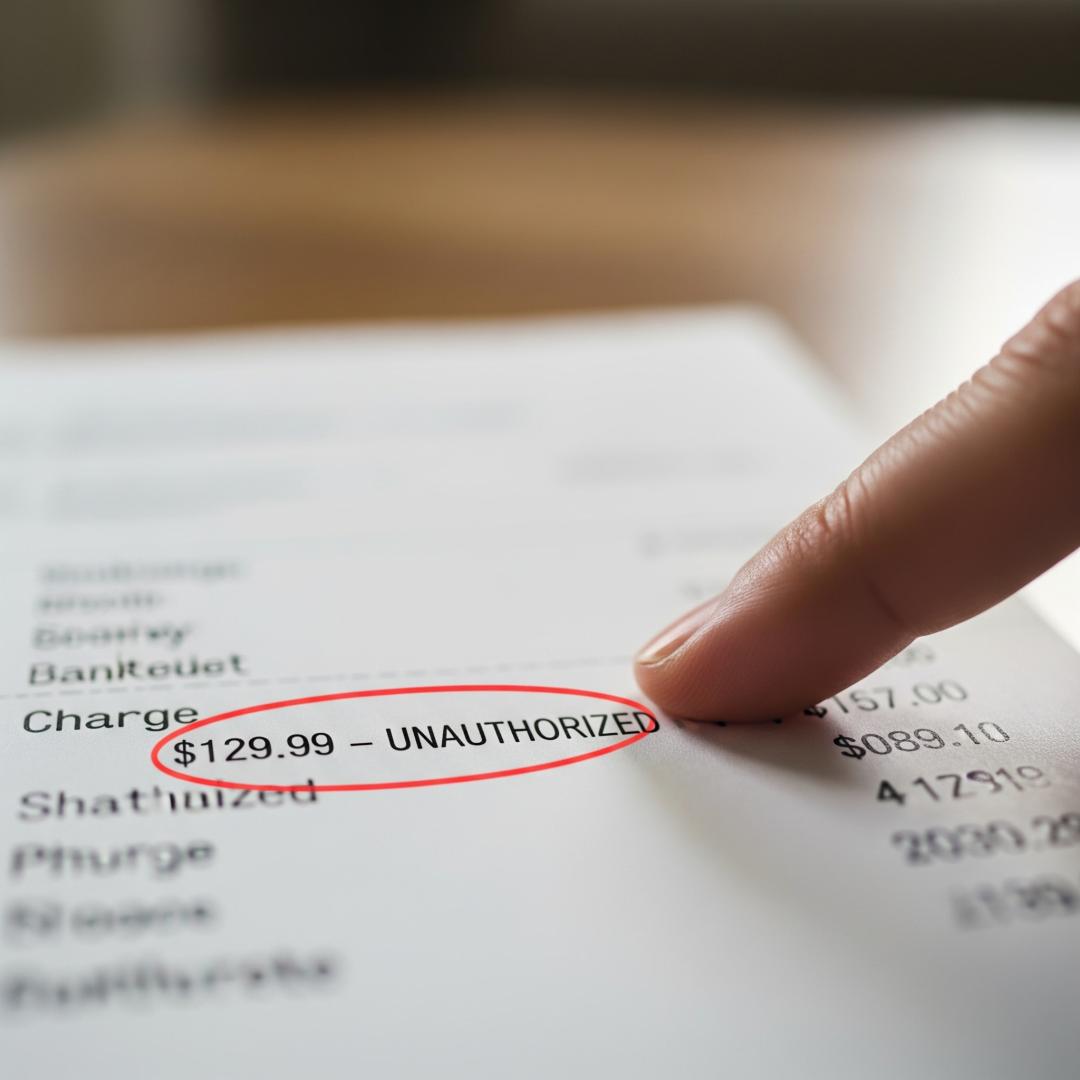

Spotted a charge you didn’t make? Here’s what to do next.

It shows up on your bank statement like a bad plot twist.

A charge you didn’t expect. From a company you’ve never heard of.

And suddenly, you’re the main character in a story you didn’t sign up for — the one where your money disappears.

Whether it was a bogus website, a fake seller, or a “free trial” that wasn’t so free, one thing’s clear: you’ve been scammed. Now what?

This isn’t just about chasing refunds. It’s about reclaiming control. In this guide, we’ll show you how to dispute scam charges with your bank — step by step, with tips that actually work. Because getting your money back shouldn’t be a mystery.

Before you dive into panic mode, take a deep breath and double-check the charge. Some transactions may just look suspicious but aren’t fraudulent. Others? They’re textbook scams.

Could It Be Legit?

Ask yourself:

If the answer to any of these is yes, you may have just made a mistake, not been scammed.

Red Flags for Fraud

But if the charge is:

…it’s probably not legit.

Scammers often test stolen cards by charging a tiny amount first. If that goes through, they may attempt larger transactions.

Don’t ignore it — a small odd charge is often the first sign of something bigger.

The moment you suspect fraud, speed is your best defense. The sooner you report it, the better your chances of getting your money back.

Here’s What to Do:

1. Use your bank’s mobile app or website to flag the charge.

2. Call the customer service number on the back of your card.

3. Request a freeze or replacement of your card.

4. Check for other fraudulent transactions.

5. Take notes.

In many countries, the law protects you, but only if you act fast.

Once you’ve notified the bank, the next step is to file a formal dispute. This initiates the investigation process.

What You'll Need:

Most banks let you do this online, but you can also:

What Happens Next?

Once your dispute is submitted:

Keep an eye on your account during this process. If additional charges appear or new scam attempts pop up, notify the bank again.

Most banks want to protect their customers, but not all disputes go your way. If your claim is denied or ignored, don’t give up.

Start by:

If you're still stuck, escalate outside the bank:

UK Residents:

Canada:

These organizations can often pressure banks to reevaluate or resolve disputes more fairly.

Once you’ve handled the immediate problem, it’s time to fortify your defenses. Scammers may come back for more or try a different angle.

Here’s How to Secure Your Finances:

1. Freeze Your Credit

You can freeze your credit report at no cost from the major credit bureaus. This prevents new accounts from being opened in your name.

2. Set Up Account Alerts

Enable transaction alerts for every charge, even the small ones. Many banks let you set thresholds (like notifications for anything over $1).

3. Use Virtual Cards

Services like Apple Pay, Google Pay, or privacy.com let you generate one-time-use or merchant-specific cards, making it harder for scammers to reuse your info.

4. Secure Your Logins

Use strong, unique passwords and turn on two-factor authentication (2FA) for your banking, email, and shopping accounts.

5. Review Your Statements Regularly

Make it a habit to scan your statements weekly. The earlier you catch something, the better your chances of fixing it.

Some scams don’t go through your card or bank directly, like sending money via:

These are much harder to recover.

Try This:

1. Contact the payment service immediately

2. File a police report

3. Report to scam hotlines or watchdogs

4. Warn others

Sample Scripts You Can Use

To your bank:

“Hello, I noticed a charge on my account from [Merchant Name] on [Date] for [$Amount]. I did not authorize this and believe it may be fraudulent. I’d like to file a dispute and have my card blocked as a precaution.”

To dispute in writing:

“I am writing to formally dispute a fraudulent charge on my account ending in [XXXX], dated [XX/XX/XXXX] for the amount of [$Amount]. I have never authorized or made a purchase from [Merchant Name]. I have attached supporting documentation, and I request a full investigation and reversal of the charge.”

Getting scammed can feel frustrating and embarrassing, but it happens to millions every year. Scammers are slick, and even the savviest people get caught off guard.

The important thing is not to freeze in fear. Act fast, report the fraud, and take back control. Every step you take helps shut the door on scammers — and keeps your future money safe.

Before you click, check with ScamAdviser.com—it’s a quick way to verify websites, phone numbers, crypto wallets, and even IBANs. On mobile? No worries—the ScamAdviser app has you covered 24/7, keeping you safer wherever you browse.