Scams are everywhere. Some are obvious, some are shockingly clever, and some… well, they can make you question reality. From AI deepfakes to fake job offers, criminals are constantly inventing new ways to steal money, data, or trust. Here’s your A–Z survival guide to the scams you need to know in 2025—explained in a way that’s easy to read, practical, and, yes, a little fun.

AI scams are getting downright sci-fi. Criminals can mimic voices or create hyper-realistic videos of someone you know. This is called a deepfake scam. Amazon scams, on the other hand, prey on trust: fake sellers, fake shipping notifications, or emails claiming your account is “at risk.”

Tip: always go straight to the official site and never click suspicious links.

Your bank will never call to demand your password, but scammers will. Bitcoin and NFT rug pulls lure investors into thinking they’re getting in early, only to vanish with your money.

Rule of thumb: if an investment sounds too good to be true, it almost always is.

Heartfelt donations can be weaponized. Charity scams spike during disasters or holidays. Similar to the Thailand Earthquake scam, Disaster struck, people donated, and scammers collected. It’s that simple. Credit card scams often use cloned cards or fake online stores. Always verify causes and vendors before parting with your money.

Romance scams are surprisingly effective—someone builds trust, then invents a “crisis” that requires money. Debt collection scams use fake legal threats to scare you into paying. Red flag: urgent demands from strangers.

“Your account is locked—click here!” Classic phishing. They push you with fear and urgency, hoping you don’t have enough time to see through their dirty tricks. Employment scams lure job seekers with fake postings or ridiculous “sign-up fees.” Learn how to identify fake job offers online before sending your CV.

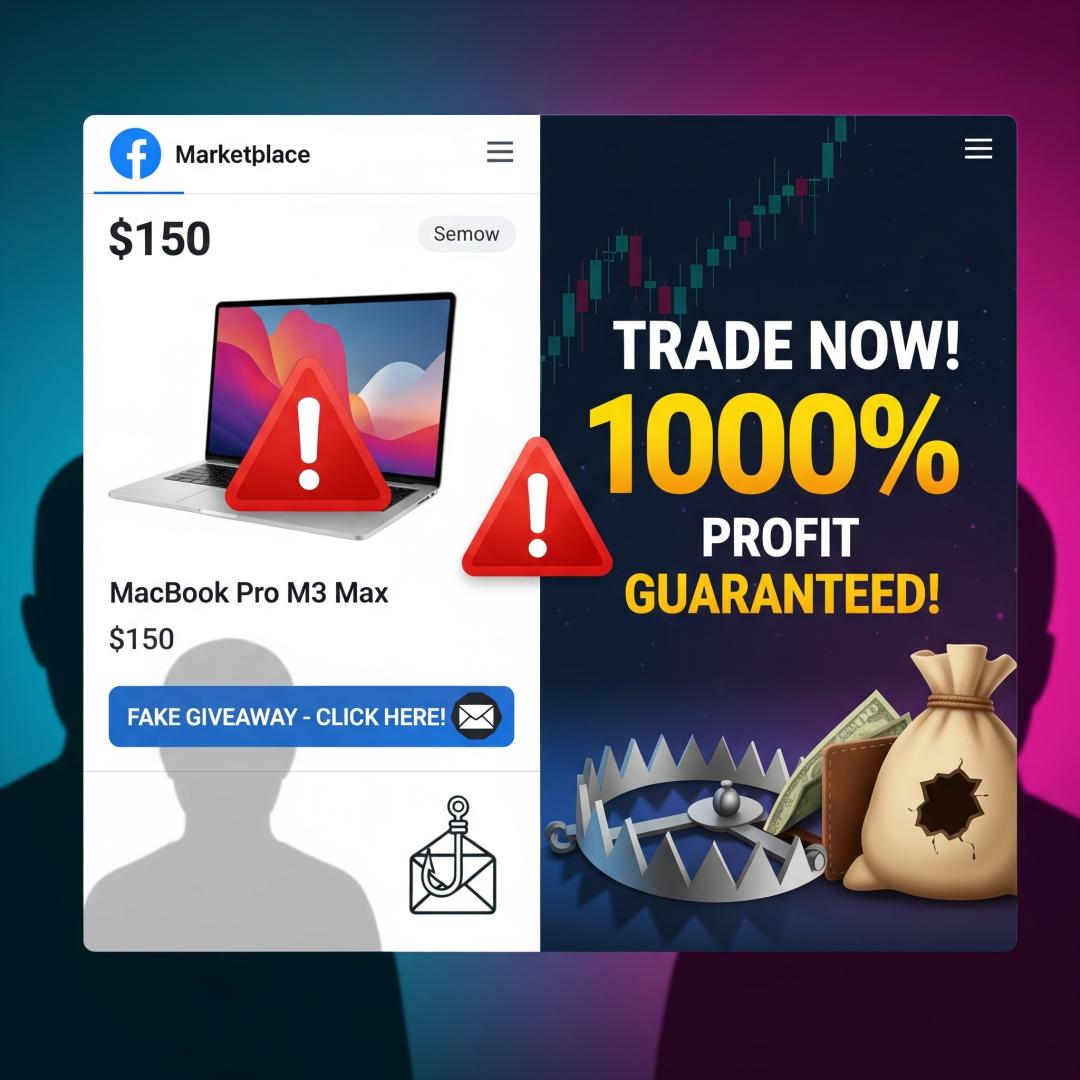

Facebook isn’t just for memes; it’s a hunting ground for phishing, fake giveaways, Facebook marketplace scams, and profile impersonations. Marketplace scams often involve fake listings for items that don’t exist—victims pay upfront and never receive the product. Forex scams promise huge trading profits but deliver empty accounts.

Pro tip: If the Forex opportunity is really that profitable, why are they asking for your small “training” or “setup” fee? Always question upfront payments.

Executive impersonation fraud is when scammers pose as CEOs or government officials, asking for cash. Giveaway scams promise prizes but demand “fees” or personal info first.

Pro Tip: If you didn’t enter a competition, there’s no way you can win—so don’t fall for messages claiming otherwise.

Miracle cures, fake supplements, and bogus home repair offers thrive on fear and urgency.

Pro tip: If a health or repair “deal” is pushy or guarantees results, avoid it.

Identity theft can ruin your credit and reputation. Instagram scams often involve fake influencers or phishing links disguised as promotions. Always check the source before sharing personal info.

Fake jobs are everywhere online. Always double-check the company, recruiter, and any job offer before sharing personal info or paying fees. Jackpot or lottery scams work the same way—they promise huge winnings but ask for upfront fees or bank details.

Pro Tip: If you didn’t apply or enter, you didn’t win. And if someone is offering a lot of money for a small task, just know you are on a scammer’s radar.

Kidnapping scams pretend that a loved one is in danger to extort money. KYC (Know Your Customer) scams ask for personal documents under the guise of verification. Real companies never demand sensitive info unexpectedly.

Loan scams love to dangle “quick cash” in front of you—but there’s a catch: first, you have to pay an upfront fee. Spoiler alert: the money never arrives, but the scammer’s wallet gets a workout.

LinkedIn scams are the professional world’s version of a Trojan horse. They promise “exclusive business opportunities” or “high-return investments” to ambitious professionals—but it’s usually just a clever way to grab your personal info or hard-earned cash.

Pro Tip: If it sounds like a no-brainer, it’s probably a no-way scam.

Mobile scams are everywhere—your phone is basically a playground for cybercriminals. They might send a phishing SMS disguised as a bank alert, trick you into installing a malicious app, or even try to steal your banking details outright. These aren’t just annoying—they can lead to identity theft, drained accounts, and hours of stress.

Pro Tip: Only download apps from official app stores, check reviews and permissions carefully, and never click links in unsolicited texts or emails. If it feels off, it probably is. Remember: a tiny tap could cost you big bucks.

NFT rug pulls lure people in with the promise of “the next big digital collectible,” often backed by flashy websites, hyped-up social media buzz, and promises of skyrocketing value. Once enough small investments pour in, the creators disappear—deleting accounts, shutting down sites, and leaving investors with worthless tokens.

Nigerian letter scams—also called 419 scams—are the OG of online fraud. They arrive in your inbox dressed as desperate pleas from a prince, government official, or wealthy stranger who just needs your “help” to transfer a fortune. The catch? They require fees, personal info, or bank details first. In the end, instead of receiving millions, victims lose their own savings.

Pro Tip: If it sounds like a movie plot or promises “too good to miss,” it’s usually too good to be true.

Online dating scams are heartbreak and theft rolled into one. Scammers build fake profiles, charm their way into your trust, and spin stories about emergencies, sick relatives, or stranded travel plans—anything to tug at your heartstrings and your wallet. Victims often don’t just lose money; they lose months or years to someone who never existed.

Overpayment scams play the “oops” card. You sell something online, and the buyer “accidentally” sends you a check for too much. They politely ask you to refund the extra before the check clears. Once your bank bounces it as fake, you’ve already sent real money straight to the scammer.

Pro Tip: In love or in business, if someone you’ve never met in person asks for money, stop and verify before you send a cent.

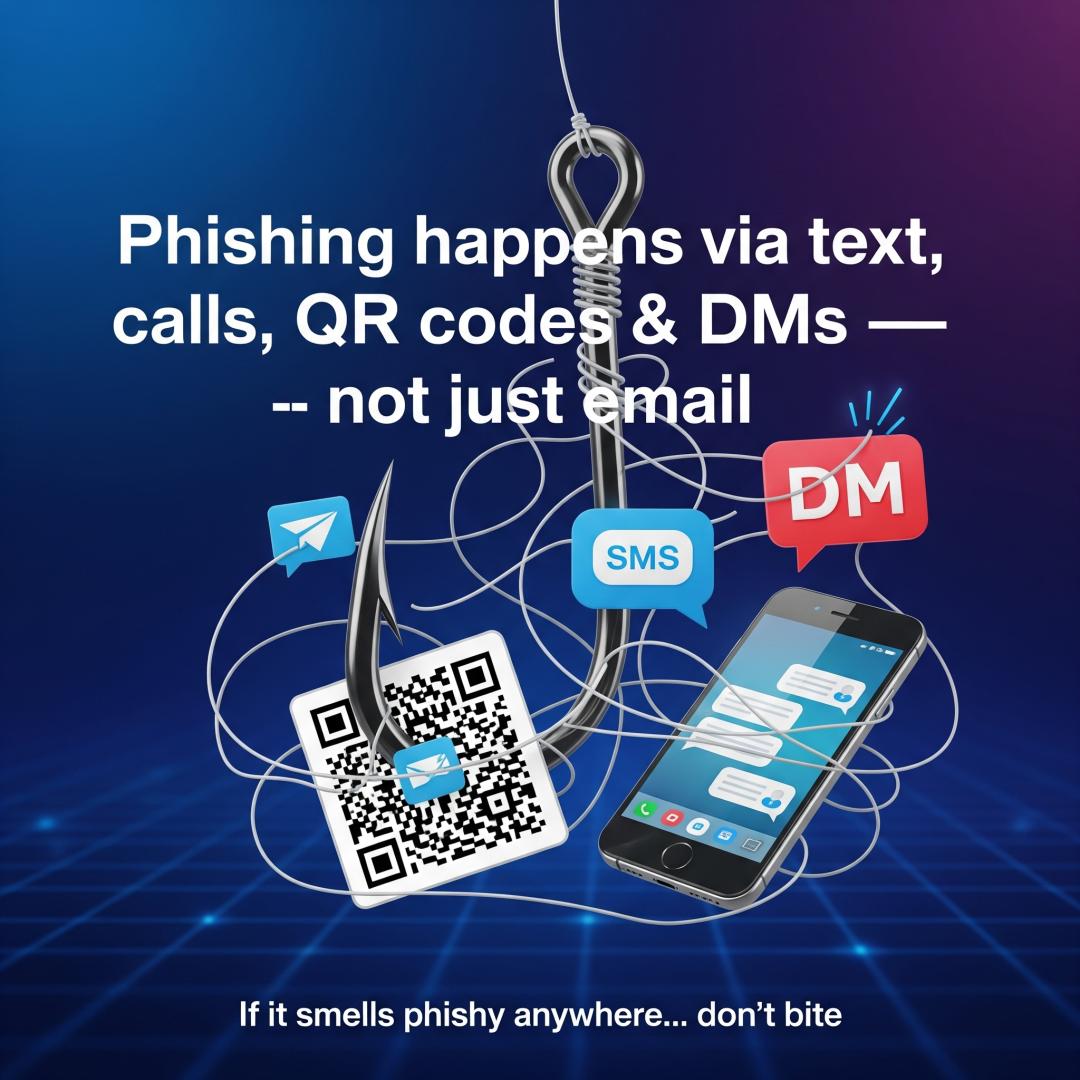

Phishing is still king in the scam world—slick emails, fake login pages, and urgent messages designed to make you panic-click. In 2025, scammers are even craftier, copying real brands and using AI to perfect their bait. One click on a suspicious link can hand over your passwords, banking info, or entire identity.

Pig butchering scams are long cons with a gourmet twist. Scammers “fatten” you up with sweet talk, fake investments, and small, convincing payouts. Once you’re hooked and all-in, they drain your account in one big, devastating hit—leaving you with nothing but regret and a very empty wallet.

Pro tip: Treat unsolicited links like mystery meat—don’t touch them unless you know exactly where they came from.

Phishing scams come in many forms

New QR code scams—also called Quishing—are turning those little black-and-white squares into big trouble. Scammers replace real codes with fake ones, so when you scan them, you’re sent to phishing sites that steal your login details or payment info. They’re popping up on posters, parking meters, restaurant tables—anywhere you’d expect to find a legit QR code.

Quick-money schemes are the same old trap in a shiny new wrapper. They promise fast, effortless wealth—crypto flips, secret side hustles, guaranteed returns—but the only thing you’re guaranteed is an empty bank account.

Pro tip: Before scanning any QR code, check if it looks tampered with or placed over another code, and when in doubt, type the URL manually.

Ransomware is like a digital kidnapper—it sneaks into your system, encrypts your files, and demands payment (usually in cryptocurrency) to give them back. Pay up, and there’s still no guarantee you’ll get your data unlocked; refuse, and you risk losing everything from personal photos to critical business documents.

Romance scams are heartbreak with a price tag. Scammers build trust and affection over weeks or months, then drop a fake crisis—medical bills, travel emergencies, frozen accounts. The emotional pull makes victims act fast, sending money to help someone they think they love… but who never existed in the first place.

Pro tip: Real love won’t lock your files, and it definitely won’t ask for urgent bank transfers.

SIM swapping is a high-tech hijack. Scammers trick or bribe mobile providers into transferring your phone number to a SIM card they control. Once they have it, they can intercept verification codes, reset passwords, and access everything from your email to your bank accounts—sometimes within minutes.

Seniors are becoming prime targets for voice cloning scams. Using AI, fraudsters mimic the voice of a loved one—often a grandchild—in distress. They call, sounding eerily real, and beg for urgent help, usually asking for a wire transfer or gift cards. The panic and realism make it hard to pause and verify.

Pro tip: Add a PIN to your mobile account, and agree on a secret code word with family for real emergencies.

Tech support scams start with a pop-up, phone call, or email claiming your computer is infected. The “technician” offers to fix it—if you give them remote access or pay a fee. In reality, there’s no virus until they plant one, and the only thing they clean out is your wallet.

Ticket scams prey on excitement for concerts, sports, or travel. Scammers post fake listings or resell forged tickets online, often at irresistible prices. Victims pay upfront, only to discover the tickets don’t work—or don’t exist at all—when it’s too late.

Pro tip: Real tech support doesn’t cold call you, and real tickets come from verified sellers.

Utility scams turn the lights out—figuratively. Scammers call or message pretending to be from your power, water, or gas company, warning that service will be cut off unless you pay immediately. The urgency pushes victims to hand over card details or send payments to fake accounts.

Unemployment scams target people looking for work or claiming benefits. Fraudsters pose as recruiters or government officials, asking for personal details like Social Security or ID numbers to “process” applications. Instead, they use that info to commit identity theft or file fake claims in your name.

Pro tip: Always confirm through your provider’s or agency’s official website or hotline before making any payment or sharing personal details.

Vishing—short for voice phishing—happens when scammers call pretending to be from your bank, a government agency, or even tech support. They use urgency, fear, or fake authority to trick you into revealing passwords, PINs, or account numbers. One convincing call can cost you your money, identity, or both.

Voucher scams dangle tempting fake offers—gift cards, discount codes, or “limited-time” deals. Victims click links or pay small fees to claim them, only to find the vouchers are worthless or a front for stealing personal and payment information.

Pro tip: Treat unsolicited calls like uninvited guests—don’t hand over your valuables without checking who they really are.

WhatsApp scams often arrive disguised as friendly chats—from hacked accounts of people you know or from strangers pretending to be acquaintances. They might share urgent requests for money, suspicious links, or “investment opportunities.” Because the messages seem personal, victims are more likely to trust and act without thinking.

Work-from-home scams lure job seekers with promises of big pay for minimal effort—data entry, mystery shopping, or “package forwarding.” The catch? They usually ask for upfront “training,” “equipment,” or “processing” fees, then vanish once you’ve paid. Some even rope victims into illegal activities without their knowledge.

Pro tip: If a job or message seems too easy, too urgent, or too profitable, it’s worth slowing down and double-checking before you reply or pay.

Holiday scams pop up like unwanted tinsel during festive seasons. Scammers exploit the shopping rush and generosity of the holidays with fake charity appeals, bogus gift offers, and counterfeit travel deals. The excitement of the season makes it easy to overlook red flags—until your wallet feels the chill.

Expense reimbursement scams target both employees and businesses. Fraudsters submit fake receipts, inflated costs, or forged documents to claim refunds or payments they’re not owed. In some cases, scammers pose as company executives, tricking finance teams into processing bogus reimbursements.

Pro tip: Whether it’s holiday cheer or business expenses, always verify before you give—because scammers count on you being too busy to check.

Fake YouTube promotions or ads can look just like the real deal—slick graphics, convincing hosts, and official-looking logos. But click through, and you could land on a phishing page or download malware that steals your data. Some even pose as giveaways from popular creators, asking you to “verify” your account or pay a small fee to claim a prize.

Yield investment scams lure victims with promises of sky-high returns—often wrapped in buzzwords like “crypto staking,” “forex trading,” or “guaranteed profits.” In reality, the opportunities don’t exist. Early payouts, if any, are just bait to make you invest more before the scammers vanish with it all.

Pro tip: If an ad or investment promises risk-free riches, the only thing it’s rich in is lies.

Zoom scams happen when fraudsters crash or impersonate meeting hosts, tricking participants into sharing sensitive information or clicking malicious links in the chat. Some send fake meeting invites that lead to phishing pages designed to steal your login credentials before you’ve even joined.

Zelle scams exploit the fact that payments on the platform are instant and irreversible. Scammers pose as friends, sellers, or even bank representatives, convincing victims to send money for fake purchases, “account verification,” or bogus emergencies. Once the transfer is made, the money is gone for good.

Pro tip: Double-check meeting invites and payment requests—especially when they come with urgency—because once you click “Send,” there’s no undo button.

Of course, there are countless other scams out there—some just wear different hats but play the same tune: stealing from you. Whether it’s “investment opportunities,” “urgent deliveries,” or “royal inheritances,” the end game’s the same. Before you click, pay, or trust, check URLs, phone numbers, IBANs, or crypto addresses on ScamAdviser. And if you’re glued to your phone, the ScamAdviser app is like having scam radar in your pocket—minus the annoying beeps.